Foreign Exchange Hedging - Putting More Flow into Your Cashflow

Volatility in the market creates hedging opportunities. You can more accurately forecast margins, and have peace of mind knowing your costs won’t increase.

١٢ فبراير ٢٠١٩ — 4 min read

This article is one of a three part series originally published in the Rosebank Business Association Roundabout magazine.

Any business that imports or exports goods or services has a foreign exchange requirement. Depending on how large the volume of their orders and/or sales, foreign exchange can significantly impact gross margins and has the ability to derail profit.

Importing costs fluctuate with the value of the local currency - for example, the New Zealand dollar (NZD). In the past 5 years, the NZD has moved by an average of 8% per year. In that same timeframe, if your suppliers either increased or decreased their prices by this amount, most people would do everything possible to try and mitigate the downside. This is a primary value-add of foreign exchange traders and brokerages that have the best interests of their clients in mind.

How to hedge

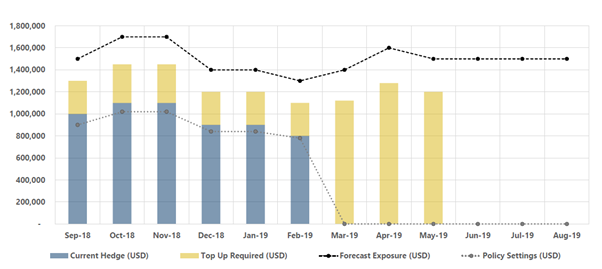

Volatility in the market creates hedging opportunities. By hedging, you are able to more accurately forecast margins, and have peace of mind knowing your costs won’t increase. This allows you to focus on your core business functions, be they manufacturing, distribution, or otherwise.

A forward exchange contract (FEC) allows you to buy or sell a defined amount of foreign currency on a given date in the future at a defined rate. The disadvantage of an FEC is that you may miss out on favourable market movements. However, since consistently accurate crystal balls aren't standard issue for any ForEx advisor, the hard part is knowing where the market will go.

Experience, expertise, and depth of information resources are two of the differentiating factors between XE and our competitors.

What stops hedging?

Hedging challenges arise when your forecasts aren’t reliable, and you receive inaccurate information from sales or production advisors. Or perhaps you are running a lean supply-chain and don't want to commit tying up cash flow to an FEC.

You can incorporate hedging into your budgeting to ensure your costed rates are covered. This prevents a situation where the currency is lower than what you’ve budgeted, and potentially a loss is being made each time you purchase FX.

For exporters, there is even less appetite to hedge. This is partly because the NZD has been strong over the past 5 years against most currencies.

The importance of interest rates

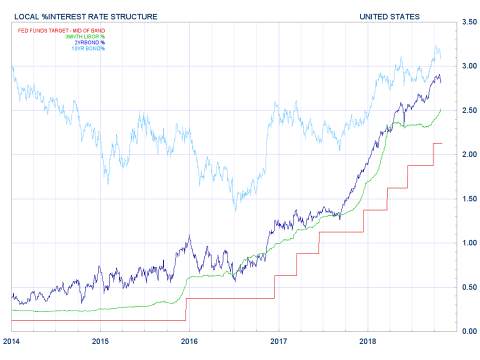

Every country wants their currency lower to attain more from exports. You will hear New Zealand's Reserve Bank (RBNZ) say they want the currency lower. In their view, having the NZD/USD rate at 65c instead of 75c is a major positive. This isn’t what importers want to hear, but it’s the reality of the foreign exchange markets.

Interest rates dictate currency movements. The RBNZ pays particular attention to inflation, wages, GDP and employment data to make their decisions. But, the NZD is at the mercy of international reserve banks, including the US Federal Reserve and the ECB (European Central Bank).

Conclusion

Volatility is here to stay. Big swings in the market will persist. It’s almost impossible to predict where the markets will move. Yet XE has the people, processes and technology to give your business the best odds of success.

It’s unfair to judge yourself on attaining the very best rate when hedging foreign exchange. Our mantra is to empower businesses to compete to their full potential in international markets.

XE works with over 6,000 clients throughout New Zealand, and several thousands more around the world to help manage foreign exchange requirements to minimise fluctuations on margins. It would be our pleasure to advise you on how to mitigate the impact of currency on your business’ cash-flow.

In further articles in this series, we'll be describing other challenges and strategies for doing business across borders, and in multiple currencies.

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information

Related Posts

١٦ يوليو ٢٠٢٥ — 4 min read

١٦ يوليو ٢٠٢٥ — 5 min read

١٤ يوليو ٢٠٢٥ — 6 min read

١٩ يونيو ٢٠٢٥ — 6 min read

١ مايو ٢٠٢٥ — 5 min read

١٥ أبريل ٢٠٢٥ — 6 min read