- Home

- Blog

- Life Abroad

- Foreign Real Estate Investment Facts You Need to Know: European Style

Foreign Real Estate Investment Facts You Need to Know: European Style

We explore the most popular European countries for foreign real estate investors, and how online money transfer can facilitate down payments and contractor fees.

٢ أغسطس ٢٠١٩ — 7 min read

Whether you are buying a European home to live in yourself, or one to lease out to generate a secondary income stream, becoming an international real estate investor is not for the faint of heart. Every country has its unique regulations and tax considerations. Arranging financing for a non-resident real estate investment is not as simple as for a domestic property purchase.

Navigating an overseas property purchase without the guidance of a local real estate broker in the country where your property is located is a real gamble, even if you have experience buying properties in your home country.

Let's explore three of the most popular European countries for foreign real estate investors to start, and we'll add more soon. Should one of these destinations pique your interest as a migration destination candidate, you'll find some data points to be aware of regarding the intricacies of purchasing a property and owning real estate there.

Portugal

If you are going to move abroad, you'll find regions like the Algarve coast and Lisbon get a lot of love from international living websites. It may be the relatively low cost of Portugese real estate, the friendly people, and the resort-like environment in many areas. We've described how Portugal is a great place to retire in other articles on our blog. Anglophones generally can live quite comfortably without learning how to speak Portugese.

Photo by Dennis Flinsenberg / Unsplash

Portugese Real Estate By the Numbers

Housing prices have actually been rising strongly of late in Portugal, increasing by 2.03% in the final quarter of 2018.

In Lisbon, property prices rose by nearly 8%.

Forecasts predict that Portugese housing prices will continue to rise through 2018, and there are no restrictions on foreign investment in Portugal, so transaction fees are quite low.

Portugal introduced a wealth tax in 2017, however it hasn't impeded real estate acquistions. The local economy has been growing at a pace of just under 2% for the past four years, and is expected to continue to do so into next year.

The real estate boom of the early 20-teens bypassed Portugal, but it is experiencing a surge now. The Global Property Guide says the country's real estate "has astonishingly good value."

Housing prices in the Azores and Madeira have gone down from their peak by about 7%, so if you are looking for a villa in a resort-like setting, these independent territories in Portugal could be just the place for you to invest in a property for your family, or to lease out to tourists on sites like AirBnB or VRBO.

Photo by Kinga Cichewicz / Unsplash

France

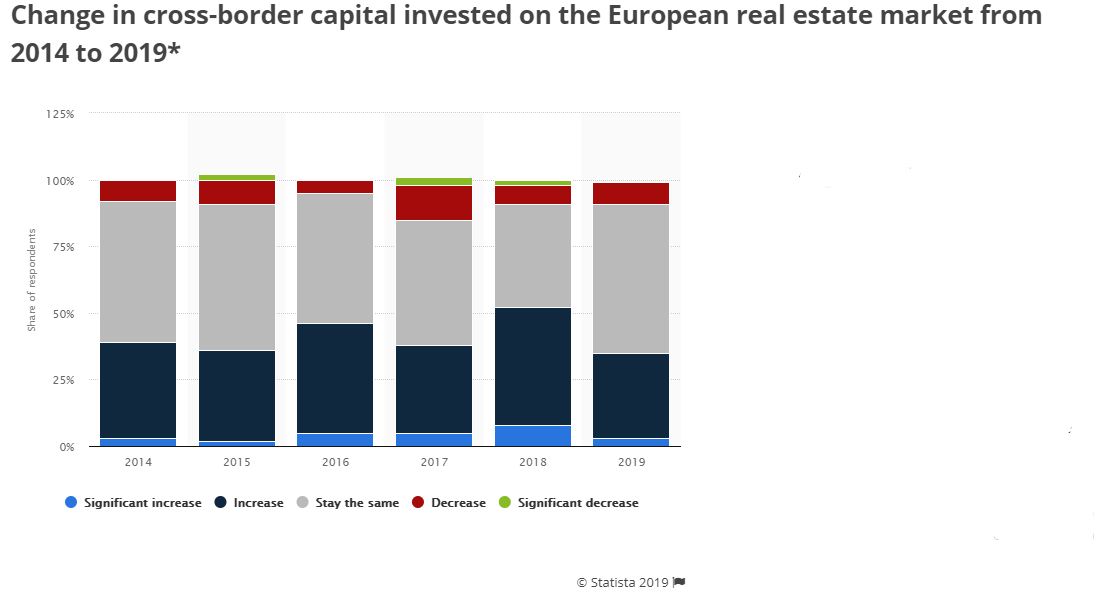

Are you planning to purchase a property in France? Perhaps you're looking for a flat in Paris to lease to tenants, or are you in the market for a summer residence in the French Riviera? France is widely considered a top country for cross-border property investment. As you'll see in the chart below, Paris has the highest rents of all the European capitals. Of course, there is the rich culture, the high urban density and concentration of employment in the area.

Though rents are high in Paris, rental agreements are long-term compared to many other countries. Unfinished apartments tend to start at three-year commitments, and many landlords tend to benefit more from long term revenue as opposed to high short term rentals. (Except for AirBnB sublets)

France Real Estate by The Numbers

In 2018, housing prices increased by about 2%, with fading demand. This price increase is in line with France's economic growth of 1.7%.

Real estate transaction fees in France are high compared to other countries in Europe, at between 7.9% and 28.99%. France's unemployment rate fell in 2018, yet at 9.2% it is higher than the eurozone's 8.5% average.

Low interest rates and lack of foreign ownership rules have kept real estate prices high in recent years. An interest rate hike is predicted in the near future, but the European Central Bank has elected to hold rates in recent quarters.

Infographic: Rent: Paris The Most Expensive European Capital

You will find more infographics at Statista

Photo by Stefan Widua / Unsplash

Germany

The German housing market has been growing for the past several years. You'll notice Berlin doesn't show up on the top-14 list above, which is because rental returns are quite low. This is in part because there are more home buyers due to low interest rates. Munich is Germany's most expensive place to live, folowed by Berlin and Frankfurt.

The recent influx of refugees and immigrants into Germany is opposed by the lack of construction activity and new home starts. The country is said to have stable mortgage and equity ratios, so there isn't as much concern about a housing bubble in Germany (despite its slowing economy) as in some other EU member countries.

Germany Real Estate by The Numbers

Housing prices climbed in Germany in 2018, and house prices increased by about 9%, though economic growth weakened to about 1.4%.

Real estate transaction fees in France are moderate to high compared to other countries in Europe, averaging at between 9.02% and 16.34% of housing purchase prices. France's unemployment rate fell in 2018, and at 3.1% is far below than the eurozone's 8.5% average.

Low interest rates and lack of foreign ownership rules have kept real estate prices high in recent years. An interest rate hike is predicted in the near future, but the European Central Bank has elected to hold rates in recent quarters.

Soon, we will expand this article to profile Spain and Sweden as opportunities for foreign property investment.

If you are purchasing a home of any size across borders, oceans, or the equator, XE Money Transfer is a safe, reliable way to transfer funds for down payments, real estate fees, or contractor services.

Before you leap into a European real estate investment, consider investigating the country's tax laws relative to your income or rental incomes.

Find out:

Whether you will need to pay capital gains taxes,

How the government will treat your property in the event of your passing in that country or abroad.

If there are controls/fees/levies in your destination country over foreign property purchases and ownership

Whether local laws favour tenants or landlords should you be investing in a property to lease out. Get clarity on whether a rate of return of under 5 percent is worth your investment, and tying up your capital for several years at a time.

Not every investor can sustain the risk of a multi-year, high value investment like buying a European property to lease to tenants. If you plan on living in your investment property in your retirement, or to sell it upon completion of the lease term, consulting with a real estate professional and legal counsel is advised.

Stay tuned for other international real estate investment content to be added to this article, and to future articles on this topic related to the Americas and APAC regions. If you feel there's a country which we should profile, let us know on Twitter or Facebook.

For all your money transfer needs to and from Europe, open a free XE Money Transfer account. You can transfer money from home, or abroad from your preferred desktop or mobile device.

Related Posts

٢ سبتمبر ٢٠٢٥ — 7 min read

١٦ يوليو ٢٠٢٥ — 6 min read

١ يوليو ٢٠٢٥ — 5 min read

١ يوليو ٢٠٢٥ — 7 min read

١ يوليو ٢٠٢٥ — 6 min read

١ يوليو ٢٠٢٥ — 7 min read