Apps and Insights to Add to Your Vacation Money Essentials Checklist

Going on vacation is great fun, though keeping track of your spending is crucial. XE.com offers a wealth of tools for sun seekers, and avid adventurers.

٨ نوفمبر ٢٠١٨ — 7 min read

Getting ready to go on holiday is always exciting, but you’ll want to make sure the trip is memorable for all the right reasons. From car hire (rentals) to currency purchases, flights to insurance cover, the cost of foreign travel increases quickly, particularly if there’s something you forget or leave to the last minute.

We’ve put together this holiday money essential checklist that could help you make your money go further when travelling abroad this year.

**1. Passports**

The overwhelming sense of despair that hits the would-be holiday-maker on the morning of their trip when they discover their passport has expired is an all-too-common and costly experience. Passports are expensive enough without having to arrange a premium-priced fast-track passport replacement. If you need to reschedule flights and accommodation, the costs get even higher.

Figures show that eleventh-hour passport renewals cost British holidaymakers £14m in 2015. Even when your passport is valid, many countries require at least a six-month buffer on your passport’s expiration date. So if you are planning on travelling during the next 12 months, check the expiration date on your passport to avoid the stress and hefty fees involved in getting a new one. It helps to note these dates on your online calendar so that you receive an early warning.

**2. Airport parking**

Arranging foreign travel can fill your mind with a multitude of pleasures and adventures to come. But airport parking isn’t usually one of them. Airports receive a huge income from parking, and leaving your car there while you’re away will leave a serious dent in your holiday budget.

The cost of airport parking generally rises as your departure date approaches. Shop around to explore your options and book in advance to get the best price. Alternatively, you could find that pre-booking a taxi from a local firm might work out cheaper. It's also more relaxing than searching for a designated parking spot that is often a coach ride from the airport – and then having to drive back home at the end of your holiday.

**3. Car hire/rental**

Planning your car hire in advance can also result in big savings. Using comparison websites, shop for the best car hire prices and value. Be aware that seemingly low-cost companies add an array of costly hidden extras at a later date – such as for GPS, insurance and fuel.

It is also worth checking the details of their insurance policy, particularly in regard to the excess/deductible. This is the amount you would have to contribute to any claim, and it varies significantly. To avoid been hit by a hefty repair bill as well as an insurance payment, see if you would be better off arranging your own insurance elsewhere.

**4. Travel insurance**

Unless you want to risk paying for cancelled flights, lost luggage and medical emergencies, don’t forget to arrange travel insurance. Again, shopping around online could help you to find a good deal. But before you sign on the dotted line, check the terms and conditions carefully for any exclusions. Insurance policies include all sorts of exclusions, so price alone may not be the best indication of the ideal policy .

The free European Health Insurance Card (EHIC) helps you access state healthcare when in Europe (at least while the UK remains part of the EU; the government is aiming to maintain access to this scheme or arrange a similar alternative after Brexit). An EHIC card ensures you receive basic medical care either for free or at a reduced cost in all member countries of the European Union (EU), the European Economic Area (EEA) as well as Switzerland, Iceland, Norway and Liechtenstein.

**5. Mobile roaming for data and voice calls**

EU roaming charges were abolished on 15th June 2017. This means anyone travelling to an EU member country can now use their mobile phone for calls, texts and data as if they were still in the UK (it is uncertain at this point if this will continue after Brexit).

You may wish to check with your mobile phone operator exactly what this means for you before you travel, as the different networks are offering slightly different coverage. For example, Vodafone has also removed roaming charges for Turkey – which is not in the EU – but other providers have not. There are also some grey areas around countries such as Switzerland, Andorra and the Channel Islands, as well as while you’re on a ferry. Canadian carrier Rogers offers a "Roam Like Home" service for a reasonable fee for roaming in countries around the world.

If you normally use WiFi to go online at home, it can be easy to lose track of your data usage when out and about without a WiFi signal. This is something to watch out for, as you could still incur significant charges here. Service providers still charge higher rates for exceeding an allowance when out of the country.

**6. Cash**

Busy tourist areas are not only popular with visitors; they are also appealing to pickpockets. It’s a good idea not to take out more money than you need. Zipping up your cash and other valuables into a secure money belt could also help. You may wish to avoid keeping anything valuable in a backpack, and if you use a handbag, it is best to hold it close to your body.

Hotels will generally provide a safe for cash and other important items that you want to leave behind in your room. Before choosing an accommodation, you may wish to check that they provide secure safe facilities.

**7. Currency exchange**

Buying your travel money is another area where you could save by buying in advance. If you leave it to the last minute and buy your foreign currency at the airport, you might end up paying significantly more. Again, planning your purchase in advance gives you the chance to shop around and find a better deal. It also means you can watch the trends on the currency markets or set up a rate alert using the XE Currency Converter, which help you to get a more favourable exchange rate.

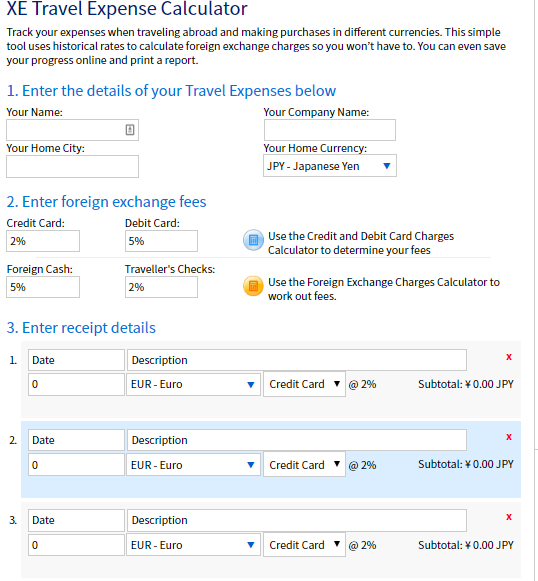

XE's Travel Expense Calculator is a simple way to track your expenses when traveling abroad and making purchases in different currencies. This simple tool uses historical rates to calculate foreign exchange charges so you won’t have to. You can even save your progress online and print a report.

XE Travel Expense Calculator

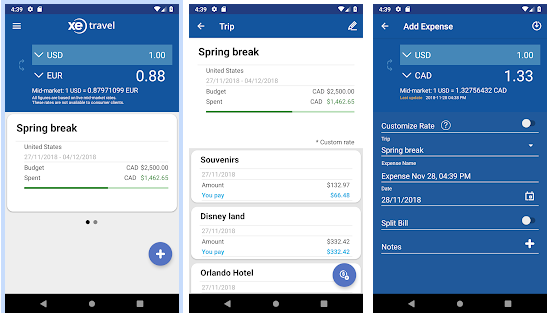

The XE Travel app for Android and iOS devices is a great way to access the same tools as the Expense Calculator while you're on the go.

XE Travel Mobile App

If you want to transfer money into an overseas bank account (either your own or to make a payment to an overseas supplier), make an international bank transfer. XE Money Transfers help you to do this quickly, easily and securely, with bank-beating exchange rates and low, transparent transfer fees*.

To get started, you can open a personal or business account for free on our website and be ready to transfer immediately.

**This does not include the cost of you transferring the funds to XE and any charges incurred where the funds being sent are in a different currency to the destination bank account, or correspondent bank charges. This is an updated version of a post that originally appeared on HiFX.co.uk*

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information

Related Posts

٤ ديسمبر ٢٠٢٣ — 4 min read

١٨ يناير ٢٠٢٣ — 6 min read

٣٠ يوليو ٢٠٢٠ — 4 min read

١٢ يوليو ٢٠١٩ — 6 min read

١ يوليو ٢٠١٩ — 6 min read

١٠ يناير ٢٠١٩ — 5 min read