- Home

- Blog

- Currency News

- The Pound Strengthens at the Likelihood of a Deal

The Pound Strengthens at the Likelihood of a Deal

October 22, 2019 — 3 min read

John Bercow, Speaker of the House of Commons, yesterday blocked Boris Johnson’s second vote to try and get through his Brexit plan.

The move denied Boris Johnson the opportunity to get his plan quickly through and the cited reason was twofold:

The plan is materially identical to the initial submission

The legislation that was voted for on Saturday had not been complete

In both cases, this meant that there really was no point in voting for the same thing again with little change and so shouldn’t really be viewed as anything other than the wheels of bureaucracy moving through the issues. In Parliament they will look to submit a Parliamentary Bill that will transform the deal into law. The process will look something like this:

The Bill is introduced

Either this will be passed or failed

If Passed, then the deal with amendments or as it is will be voted on resulting in a Brexit deal (with or without a slight delay)

If Failed, and the EU does not agree extension, then this is a No Deal 31stOctober result. If the EU DOES agree an extension, then it opens up a number of possible referendum and election choices

The Pound has performed largely as expected in terms of strength coming from greater clarity and likelihood of a deal. Against the USD, the Pound has found only a tepid run hold above the 1.3000 mark, on more than one occasion hitting the mark and retreating. Investors are likely to hold off viewing this as a new support level until a sustained run above the figure has been seen – though from a technical perspective the pair seems headed for the 1.3065-1.3070 near term target rates for this to happen.

Against the EUR, the Pound has performed similarly, the key difference being that any slippage of the strength gained last week was less pronounced against the Euro – meaning that this pair held on to the 1.1600 handle more readily and still does at the time of writing.

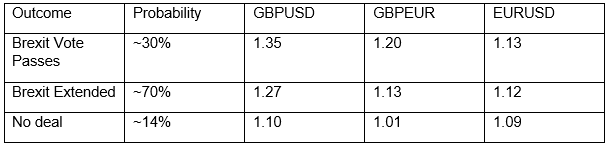

Very interesting are the forecast data being produced concerning the propensity of the scenarios to play out and the associated GBPEUR and GBPUSD rates.

Special Notes: These figures are based on the live mid-market rate, correct as of 08:30 GMT on 22/10/2019, and are provided for indicative purposes only. Live mid-market rates are not available to consumers and are for informational purposes only. The rates we quote for money transfer can be selected via the page on our website ‘Live Money Transfer rates’.

If you’d like to talk to our Business Solutions team about your business requirements, get in touch here

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

Related Posts

September 2, 2025 — 3 min read

August 7, 2025 — 4 min read

July 1, 2025 — 5 min read

June 4, 2025 — 3 min read

May 5, 2025 — 5 min read

April 7, 2025 — 5 min read