- Home

- Blog

- Currency News

- North American Non-Farm Job Growth Beats Estimates

North American Non-Farm Job Growth Beats Estimates

The US economy added about 130,000 jobs, The Canadian dollar climbed for the third consecutive session after 81,000 new Canadian jobs were added.

6. September 2019 — 4 min read

**Overview:**

The US economy added about 130,000 jobs, shy of the forecast 163,000

The Canadian dollar climbed for the third consecutive session after 81,000 new Canadian jobs were added to the workforce.

Optimism springs eternal that a no-deal Brexit can be reached after another extension or election.

**Highlight:**

Yesterday saw hopes of a de-escalation slow to an almost grinding halt, after yet another defeat for Prime Minister Boris Johnson at the hands of a parliamentary Liberal opposition strengthened by rogue MPs originally elected to the Conservative Party.

The opposition and its allies have voted to force the Prime Minister into requesting another extension of the Article 50 negotiating window, tying his hands in negotiations with the EU and opening a constitutional can of worms. If it seems like you've been on this ride before, and this is all a deja vu, you're right.

US DOLLAR

The greenback is showing little reaction after the US total nonfarm payroll employment rose by 130,000 in August, and the unemployment rate stayed at 3.7%. The headline number was below the market estimate of 163k. Last month, the average hourly earnings rose by 11 cents following 9-cent gains in both June and July. However, the market remains cautious ahead of Fed Chair Powell’s speech at 12:30 ET and which could trigger more trading activities. Commodity-linked currencies are the top performers of the day.

BRITISH POUND

The British Pound moves into a narrow range near a five-week high, fetching around 1.23 US dollar as we enter the North American session. Once again, the ongoing The British Pound moves into a narrow range near a five-week high, fetching around 1.23 US dollar as we enter the North American session.

Once again, the ongoing Parliamentary debate around Brexit will continue to inject volatility and dictate the direction of the GBP/USD. As of this writing, there is growing optimism that a hard no-deal exit can be avoided – either through another extension to Article 50 or a general election. The parliamentary debate around Brexit will continue to inject volatility and dictate the direction of the GBP/USD. As of this writing, there is growing optimism that a hard no-deal exit can be avoided – either through another extension to Article 50 or a general election.

EURO

The spot market for the single currency is range-bound, after failing to pierce the 1.11 barrier. As expected, investors prefer to avoid heavy directional bets ahead of the US job report and ECB meeting. There are increasing expectations that Draghi will make an announcement on the new QE measures. The German economy continues to spew disappointing data: industrial production fell 0.6% in July over the previous month. The revised Q2 EU GDP growth was flat at 0.2% compared to a 0.4% growth in Q1. With the US Dollar Index bouncing back from yesterday’s lows, we expect the Euro to remain confined within a tight trading range today.

CANADIAN DOLLAR

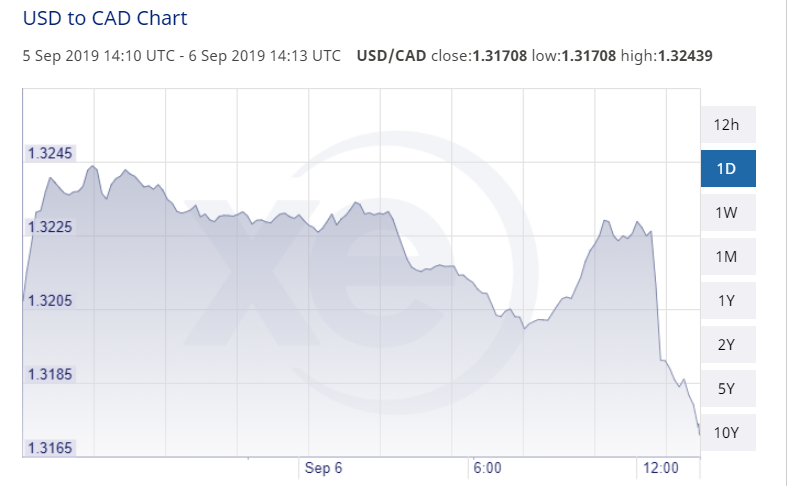

The Canadian dollar has strengthened over the past three sessions against the greenback following a no-change rate announcement from the Bank of Canada. Investors were met with a surprisingly strong employment report card. Following three consecutive months of flat performance, the economy added 81k new jobs in August. The market was pricing in the growth of 18k. The unemployment rate remained at 5.7%. Backed with strong economic fundamentals, we expect the central bank to have a new headache next month on whether to buy the insurance rate cut or continue with its patient hold

AUSTRALIAN DOLLAR

AUD USD continues to climb higher in positive territory, pushed higher on Friday when China's central bank announced a 0.5% cut to the reserve requirement ratio (RRR) as an economic stimulus strategy. The pair is currently up to 0.68531.

FEATURED CURRENCY

USD/JPY is steady around the 107 mark, after touching its highest level in five weeks carried by risk-on appetite. The pair now waits for the NFP report. Fed Chair Powell is also due to deliver his speech on monetary policy and economic outlook at 12:30 ET and which could inject some trading impetus in the market. It is very unlikely he will depart from his recent stance, which is that monetary policy tools may have limited impact in the environment of the escalating trade war.

**Online Money Transfers**

Moving funds between international accounts?

Sign up for XE Money Transfer and transfer money online 24/7.

You get free online quotes, so you know your costs before you book a transfer.

Related Posts

4. Juni 2025 — 3 min read

5. Mai 2025 — 5 min read

7. April 2025 — 5 min read

3. April 2025 — 7 min read

7. März 2025 — 5 min read

28. Februar 2025 — 5 min read