Send money to India from the United States

Benefit from bank-beating rates, low or no fees, and dedicated support when you send money to India

Benefit from bank-beating rates, low or no fees, and dedicated support when you send money to India

How long does it take to send money to India?

Sending money to India (INR) from United States (USD) can take anywhere from just minutes to up to 3 business days, depending on your payment method. For many popular routes, Xe offers same-day transfers or even instant transfers as soon as we receive your funds.

How much does it cost to send money to India?

The cost of sending money to India varies depending on several factors, such as the payment method, transfer amount, and the speed of the transfer. You can expect transparent pricing, with no surprise fees, so you always know exactly how much your transfer will cost before you send it.

How to send money to India with Xe

Create account

It takes just a few minutes. All we need is your email address and some additional information.

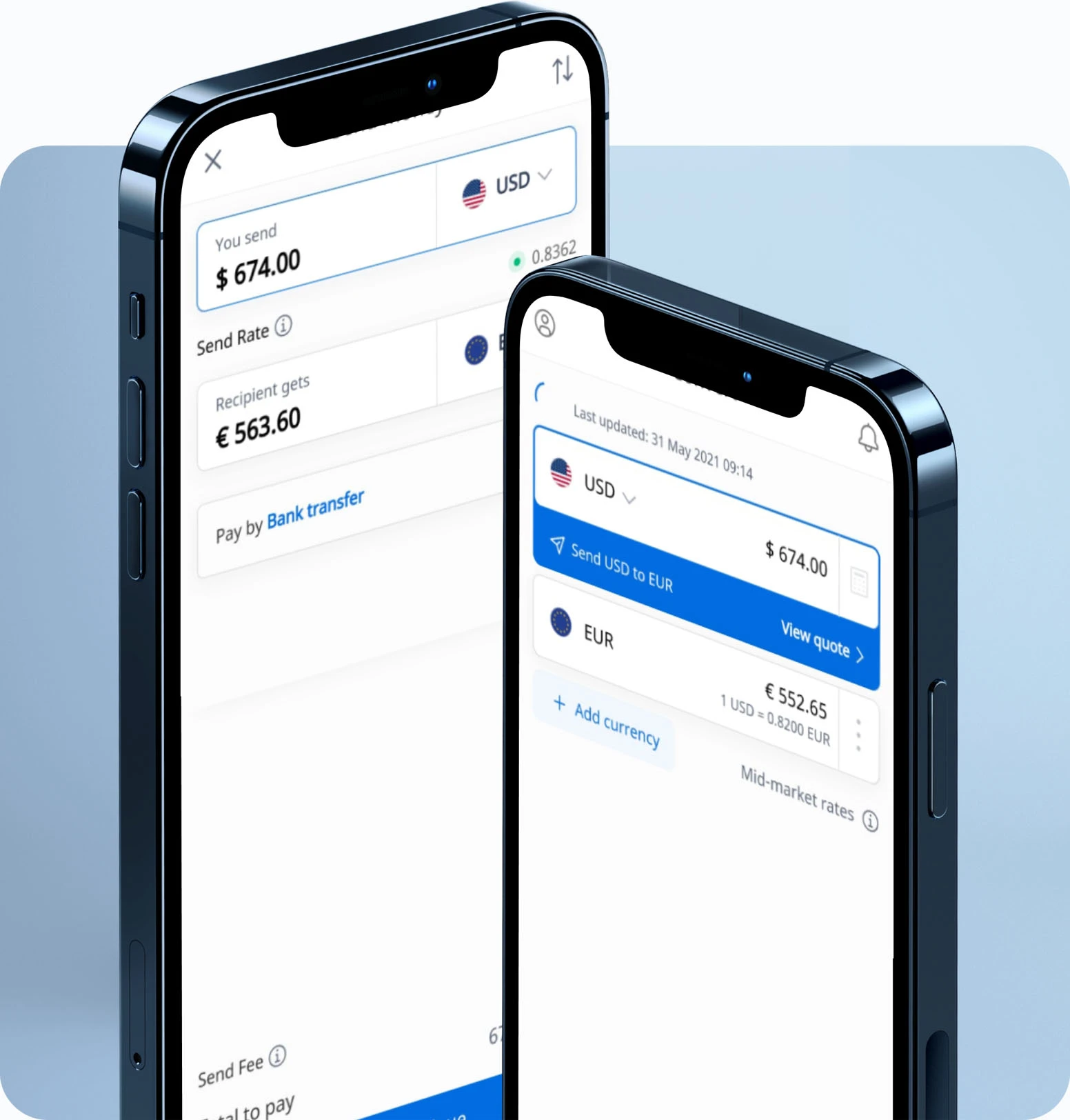

Instant quote

Receive a live bank-beating money transfer rate for your chosen currency.

Send money

Add all necessary details and set up the transfer. Once we get the funds we'll handle the rest.

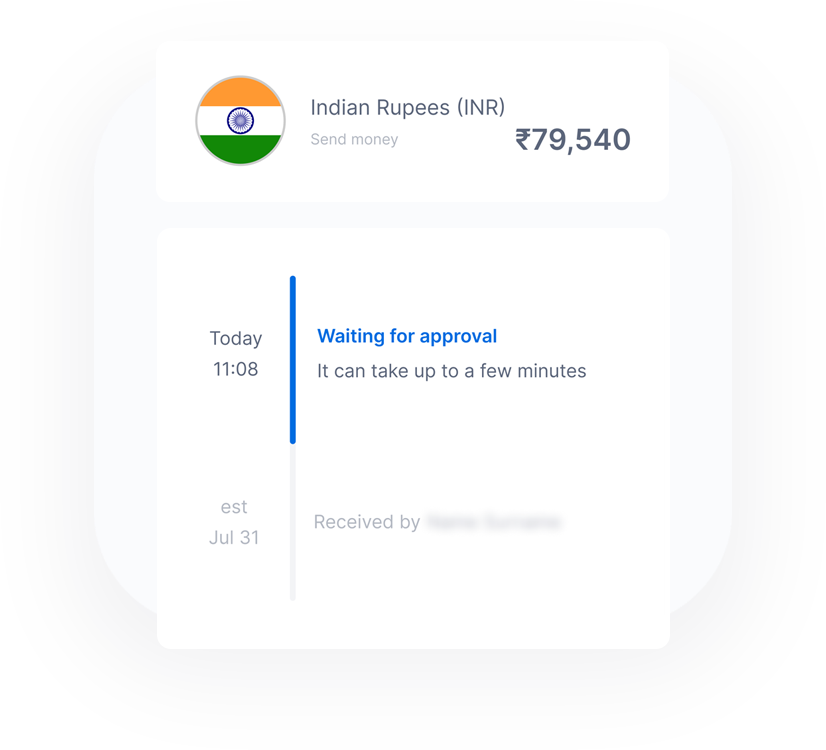

Track your transfer

Track your transfer every step of the way with our Xe app. Enable notifications to receive updates on your transfer's progress.

Why use Xe to send money to India?

Maximize your money

Competitive exchange rates and low fees ensure you keep more money in your pocket when you send money to India.

What you see is what you get

Say goodbye to surprise fees. With Xe, view and compare live exchange rates so you always know how much you’re saving, sending, or receiving.

Fast, reliable transfers

Enjoy fast and efficient transfers, regardless of the amount. Our streamlined system ensures your money reaches its destination fast.

Trusted & secure for 30+ years

Our reputation is built on trust. Over 280M people rely on our secure services to process thousands of global transactions daily.

Recommended by 78,042 verified customers

Download the Xe App to start sending money to India

The Xe Currency app has everything you need for international money transfers. It's easy, secure, and there are no hidden fees. Download the Xe App for iOS or Android and start sending money to India today!

Transfer more Indian Rupees per US Dollars when you send with Xe

Take advantage of Xe's current sending rate of 87.3233 per US Dollars when you transfer $1,000.00 US Dollars today, giving your recipient ₹87,323.29 Indian Rupees.

Multiple payment methods to India (2)

There are multiple ways to send money to India. Depending on your currency selection, you can use your debit card, credit card, a direct debit (ACH) or bank transfer.

Debit Card

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process.

Credit Card

Paying for your transfer with a credit card is easy and fast. Xe accepts Visa and Mastercard. Send money to India with a credit card today!

Direct Debit (ACH)

When you use bank debit (ACH) to fund your transfer you are authorising a one-time debit from your bank account to ours. It takes a little more time for your money to reach Xe, and as a result, can delay the speed of transfer.

Bank Transfer

A bank transfer or wire transfer is an electronic payment which sends money directly from one bank account to another. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money.

Send money to India with confidence

It's fast, simple and easy.

As part of the Euronet Worldwide family, our customers trusted us last year to securely process over $115 billion worth of international money transfers. With transparent rates and a simple platform, we make it easy to send money abroad.

Send money from 22+ countries (1)

Popular Destinations

Send money from Australia to

Send money from Austria to

Send money from Belgium to

Send money from Bulgaria to

Send money from Estonia to

Send money from Finland to

Send money from France to

Send money from Germany to

Send money from Gibraltar to

India Money Transfer Frequently Asked Questions (FAQs)

Do you have questions about sending money to India? Read our FAQs to learn more.

It's quick and easy to send money to India with Xe.

Sign in to your Xe account or sign up for a free account.

Initiate a transfer to the India, and enter the currency you’d like to transfer and the amount.

Enter your recipient’s bank information.

Provide your payment information. We accept direct debit, bank transfers, and card payments.

Confirm your transfer, and leave the rest to us.

Some of our transfers to India come with a small fee, depending on the amount you’d like to send and your payment method. We'll let you know about this fee before you confirm your transfer.

You should allow 1-4 working days for your money to arrive in India, though many transfers arrive more quickly. Before you confirm your transfer, you’ll see a more exact estimate of when your money will arrive after we receive your funds.

You can send up to $535,000 USD (or the currency equivalent) to India online. If you’d like to send more than that, you can contact our dedicated team to arrange a larger transfer.

The best way to for you to send money to India will depend on what you’re looking for in a money transfer. The payment method you choose can impact the speed of your transfer, as well as whether you’ll need to pay any extra fees. You can read more about our payment methods here.

Send money directly to friends and family's mobile devices in 35+ countries with Xe.

Mobile wallets provide a fast, secure way to send, store, and receive money. Once we receive payment, the transfer is available in the recipient's wallet app within minutes.

Available to UK, Europe, Canada, New Zealand, and USA customers from app version 7.14.0 and online. Update your app for the latest features.

To send money to a mobile wallet:

Log in to your Xe account online or in the app.

Click 'Send' in the app, or 'Send money' online.

Choose the 'Destination country'.

Complete 'You send' or 'Recipient gets' field.

Select a payment method. For urgent transfers, use debit or credit card.

Choose 'Mobile wallet' as the delivery option.

Provide the transfer reason.

Pay for your transfer.

We'll send the money to the recipient's mobile wallet upon receiving your payment.