- Home

- Blog

- Money Transfer

- Send to Receive: Money Transfer Timings Explained

Send to Receive: Money Transfer Timings Explained

The details of your transfer—such as how you’re paying and where you’re sending your money—can all impact the length of your transfer.

2020年5月1日 — 3 min read

One of the most common questions we receive is, “How long does a money transfer take?” As much as we wish we could immediately come back with a definitive answer, there’s no one-size-fits-all answer for the length of time between you hitting “Confirm transaction now” and your money transfer arriving at its destination.

In general, your transfer will be completed within 1-4 business days. The reason for this range is because no two transfers are alike, and the details of your transfer—such as how you’re paying, where you’re sending your money, and the currencies you want to exchange—can all impact the length of your transfer.

Who is Transferring

We may require you to provide additional documentation before you can make a money transfer. If we need this information from you, don’t worry: we’ll reach out to you by email to let you know what we need from you.

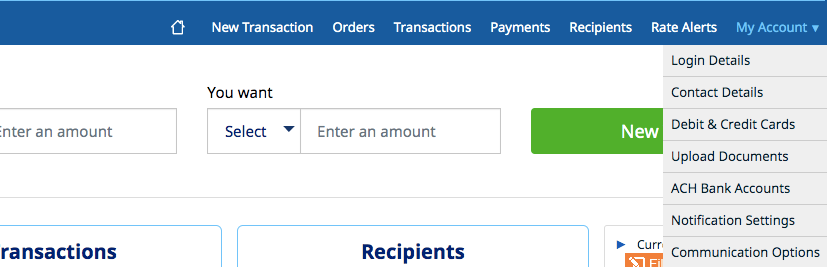

If you get this email: all you need to do is log into your account, click “Upload Documents”, and upload a copy of your passport, driver’s license, or national ID.

It should only take a few minutes, and we’ll let you know as soon as you’re good to go.

Where You’re Transferring

Where you’re sending your money could also have an impact. You won’t need to account for the physical distance your money is traveling (money transfer is a transfer of information), but there’s no guaranteeing how quickly your recipient’s bank can process the transfer, whether your transfer will need to travel through an additional intermediary institution, or what kind of payment method your destination might require. All of these could affect how long it takes to complete your transfer.

When You’re Transferring

You can initiate a money transfer online or in the app 24/7, 365 days a year. However, because money transfers typically run through banks and other financial institutions, they will be privy to these institutions’ working hours. So if you initiate your transfer late at night or on a bank holiday, you might see a small delay.

And it’s not just the banks: check the calendar for your destination as well. National holidays can affect your transfers in addition to bank limitations.

How You’re Paying For Your Transfer

There are three ways you can provide the money for your money transfer: credit or debit card, wire transfer, or ACH payment. The time to receive these payments will vary: both card payments and wire transfers are quick, and typically get your money to use within 24 hours. ACH payments can take a little longer to settle due to the number of parties involved in the payment.

What’s important to remember is that your payment and transfer date will not be kept secret. When you initiate a transfer, we’ll let you know the soonest possible date we can send your transfer.

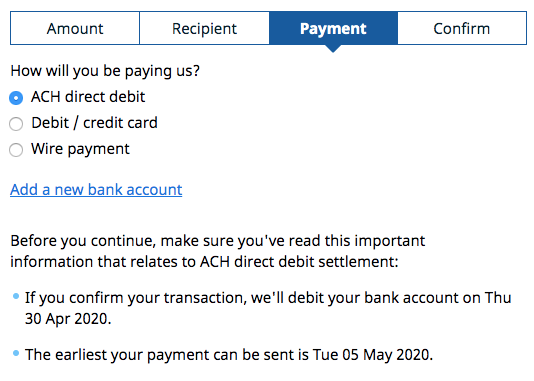

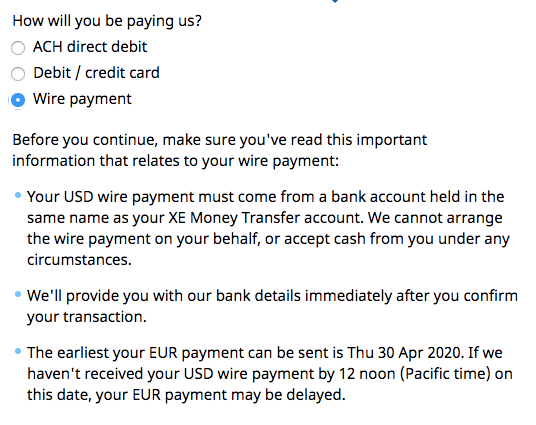

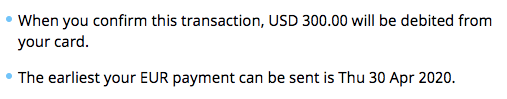

Here’s what you’d see if you attempted to initiate a money transfer on April 29, at about 5:00 in the evening:

ACH Direct Debit

Wire Transfer

Credit or Debit Card Payment

Even after you’ve confirmed your transfer, we’ll still be in touch. We’ll let you know by email when your transfer has been sent as well as when it’s arrived with its recipient. No matter what, when, where, and how you’re making your money transfer, we’ll be sure to do our best to provide you with a simple, secure, and smooth experience.

Ready to send your transfer? Log in to your account to get started.

Related Posts

2025年6月10日 — 6 min read

2025年6月4日 — 6 min read

2025年5月22日 — 5 min read

2025年5月21日 — 5 min read

2025年5月20日 — 7 min read

2025年5月15日 — 7 min read