- Home

- Blog

- Money Transfer

- Foreign Currency Exchange Pricing - What is the Interbank Rate?

Foreign Currency Exchange Pricing - What is the Interbank Rate?

The interbank rate is the mid-point between the buy and sell rate for a currency on the open market and is the most accurate rate of exchange

25 de março de 2019 — 3 min read

XE Money Transfer Pricing Essentials Guide

The foreign exchange market is a global decentralised market also known as an over-the-counter market where bank dealers make the market to determine the interbank exchange rate. For example, the rate the banks use when trading with one another.

The interbank rate is the buy and sell rate that the banks deal with each other at and is the most accurate rate of exchange at any given time. You can easily check this at any time using the XE Currency Converter.

Unfortunately for most of us, this rate is reserved solely for banks and large financial institutions trading in large amounts of foreign currency. For retail or business banking customers looking to make smaller international money transfers, a margin (or spread) will be applied to the interbank rate to ensure a profit for the service making the transfer.

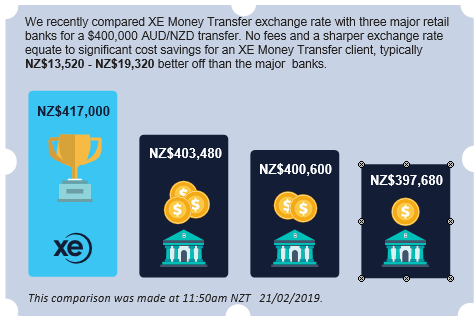

As a retail banking customer, this margin may be anywhere between ~4-5% of the interbank rate.The graph below illustrates the rate that a customer may expect to receive from the bank when converting their own currency, such as AUD or NZD to GBP.

What determines whether I receive a competitive rate?

Naturally, when sending money abroad, it’s in your best interests to ensure you keep as much of your money as possible by locking in a favourable rate of exchange.

The exchange rate you receive will be based on a number of factors, including:

Volume – the amount you are converting

Currencies exchanged

Knowledge and awareness

Transaction frequency – ongoing or one-off

However, one of the most sure-fire-ways to ensure you are receiving a competitive rate is to look at using an international money transfer services provider like XE who provides a much sharper rate of exchange than you would otherwise receive from the banks.

Why you should look beyond your bank

XE works closely with our broad network of referring partners to provide their clients with a competitive, secure money transfer solution. As such, when you choose XE Money Transfer via one of our partners, you will receive preferential rates of exchange that are more competitive than you would receive from other providers.

Interbank Rate vs Transactional Rate Comparison

The exchange rate is only part of the big picture

At XE, we pride ourselves on delivering our clients value beyond a great rate. We provide a more comprehensive service than they could expect to receive from the banks.

Exchange rates fluctuate at any given minute and as such our expert team are on hand to be your eyes and ears on the market and advise on how to ensure you lock in the best rate possible. XE also offers a range of products typically not made available to retail banking clients,including Market Orders and Forward Contracts, that will help you reduce your exposure to currency risk.

Please contact us for more info about your international payments, or click here to register and save now.

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

For more information about *XE*, please click here: Regulatory Information

Related Posts

10 de junho de 2025 — 6 min read

4 de junho de 2025 — 6 min read

22 de maio de 2025 — 5 min read

21 de maio de 2025 — 5 min read

20 de maio de 2025 — 7 min read

15 de maio de 2025 — 7 min read