Xe 2020 Survey Results: Do You Have Smart Money Transfer Habits?

We recently surveyed our audience on their money transfer habits. Now it's time to see how you stack up to the rest—and what that means for you.

2020年8月17日 — 5 min read

Not too long ago, we did a little survey on our customers’ currency exchange and money transfer habits. You might’ve seen it, and you might’ve even participated. We appreciate you taking the time to offer up your insights.

We learned several very interesting things from our survey. We wanted to share our findings with you and let you know what we learned and what we think you could learn from our customers’ money transfer habits.

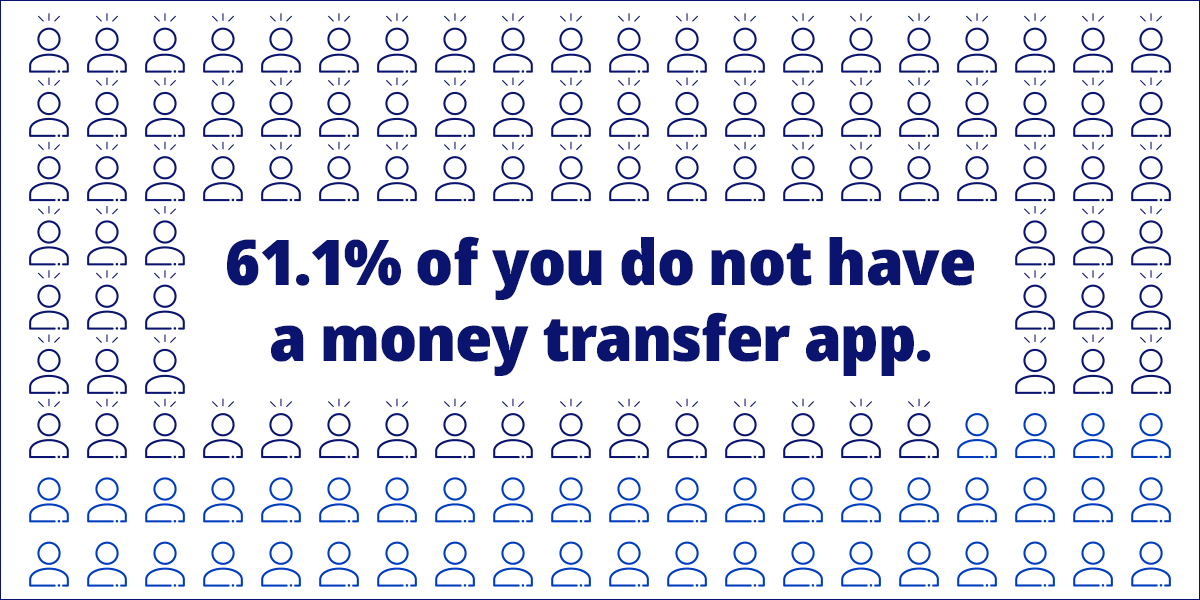

Can you initiate a money transfer online or over the phone? Technically, yes. But just because you can doesn’t mean it’s always going to be the best option.

In addition to being able to be accessed and utilized on the go, anywhere and anytime, the Xe app comes with numerous benefits including:

On-the-go access to the Currency Converter and live exchange rates

A quick, easy money transfer process, with a smooth flow from quote to send & confirm

Up-to-date transfer tracking so you’ll always know where your money is

All-new Rate Alerts to monitor your chosen currency pairs

Saving your transfer details, so you can easily pick up where you left off.

Sounds great, doesn’t it? Now think about how easy that could make your next money transfer. After all, you’ll be using Xe, not...

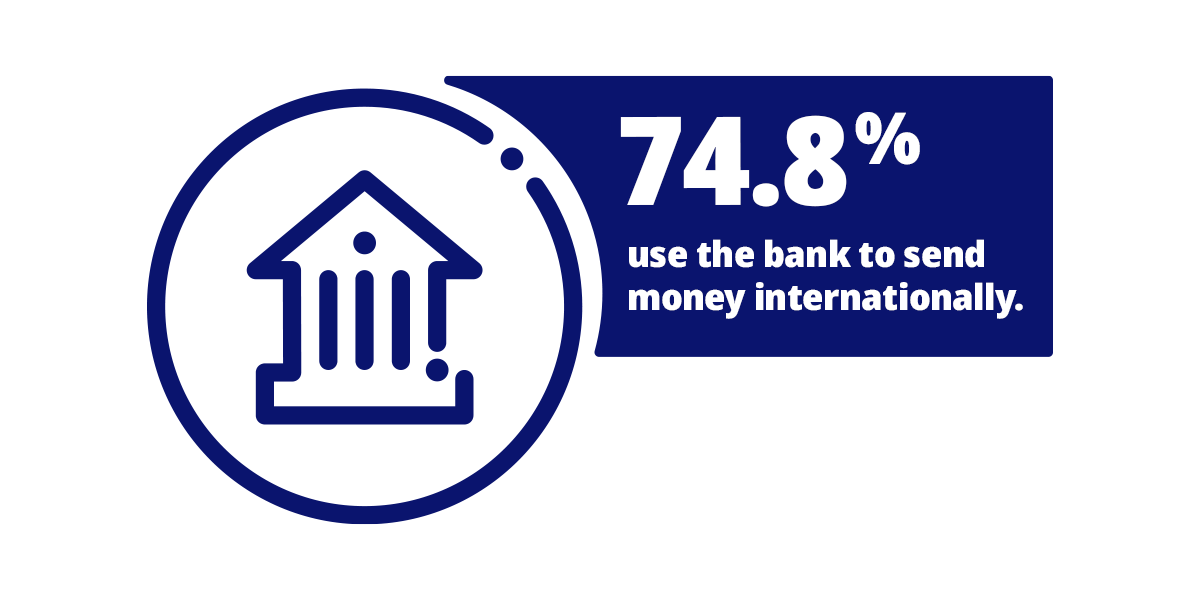

We all use banks to keep our money secure, and we trust them to do this. But when it comes to sending your money, heading to your reliable old local bank might not be the best move.

Let’s say you want to send money overseas, and you decide to use the bank. Here’s what your process will look like:

You leave your home and travel to the bank.

You get to the bank and wait in line. How long’s the line? No way of knowing until you get there.

Finally, you can speak with someone to get your money transfer arranged.

Is it Sunday? Is it before 9 am? Is it after 5 pm? Is it a holiday? Looks like you’re out of luck, and will have to wait until tomorrow (at least) to initiate your money transfer.

Sounds inconvenient, doesn’t it? Let’s see what the money transfer process is like with Xe.

You open your computer or Xe app, or make a phone call. Are you in bed? Is it 2:30 am? Doesn’t matter—you can initiate a transfer 24/7, 365 days a year, from anywhere.

You enter the information for your money transfer, and hit “Confirm.”

Your transfer has been initiated, and you’ll receive email confirmation every step of the way.

You’ve initiated your money transfer, all without having to leave the house or change out of your pajamas. Sounds much simpler to us. Now think about how much time you’ve saved.

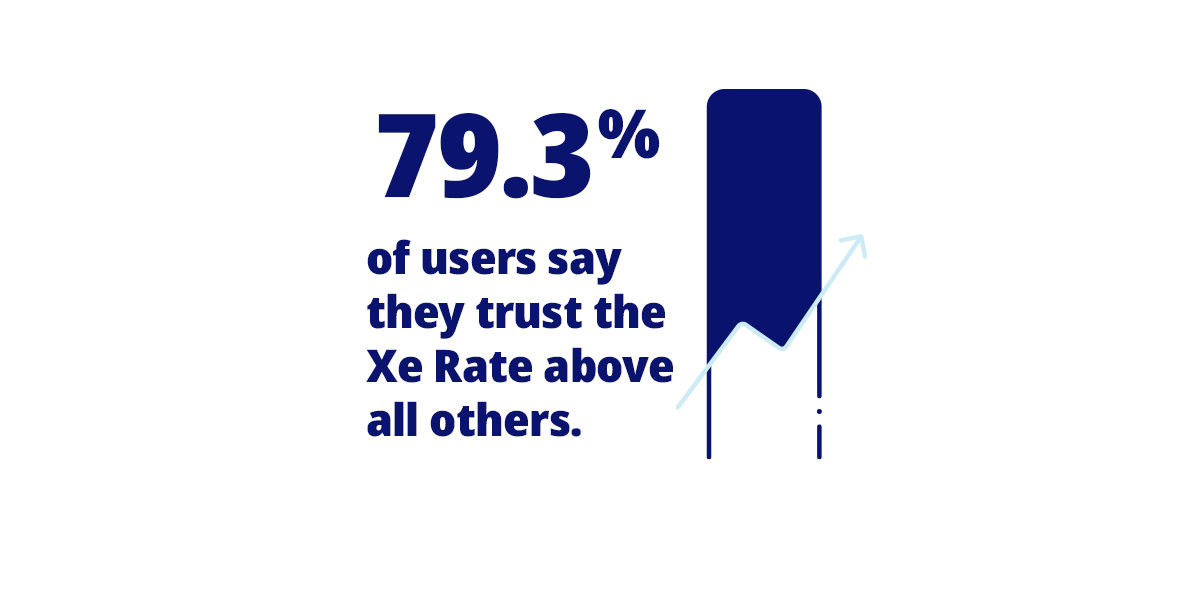

We’ve been in the currency business for a long time: over 25 years, if you’re counting. We know money transfer and foreign exchange, and our rates come straight from the live currency markets, with frequent updates ensuring that the rate you’re always seeing the most current exchange rate, with no hidden margins. With the Xe rate, the rate you see is the rate that you get.

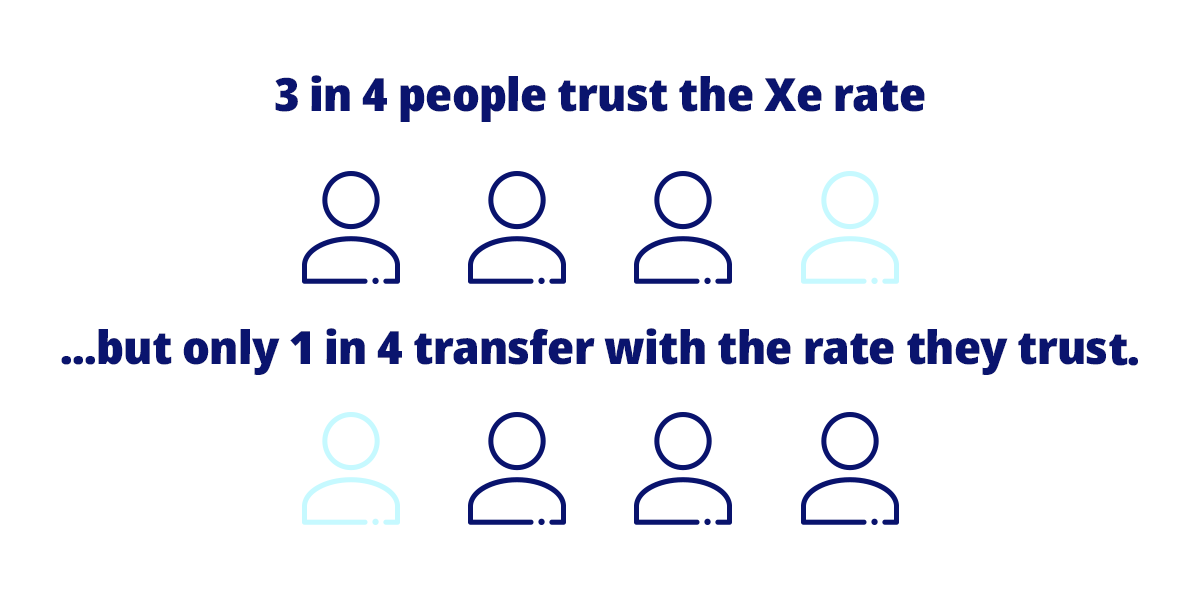

When you’re exchanging currency and sending money overseas, it’s often the rate that can make or break your transaction, and determine just how much money you’ll be paying (and your friend will receive). Are you sending with the rate that you trust?

We’ve just discussed Xe's rates, where they come from, why you should trust us, and why 79.3% of our customers do trust our rates. But as it turns out, 1 in 4 customers aren’t sticking with the rate that they trust.

You’re welcome to shop around and look at other rates. But you’re likely to only be wasting your time. The Xe Rate is informed by data from the live currency markets. Whenever the markets change, so do our rates. You won’t need to worry about an outdated rate here—ours are accurate to the minute.

3 in 4 people are going with the most trustworthy option. Do you want to be the one who isn’t?

The one who’s using unfavorable exchange rates?

The one who doesn’t send with the rate that they know is the best?

The one who can’t send money on the go?

The one who’s still waiting in line at the bank window?

The one whose money transfer habits are still stuck in the past?

With Xe, you don’t have to be the one. Instead, you can use the one: one rate, one send, one simple process.

Are you ready to transform the way you transfer? Sign up for a free account today!

Results taken from a survey of Xe customers and Xe.com users in July 2020.

Related Posts

2024年10月20日 — 2 min read

2021年12月20日 — 2 min read

2021年7月12日 — 5 min read

2021年4月30日 — 3 min read

2020年10月20日 — 2 min read

2020年10月12日 — 2 min read